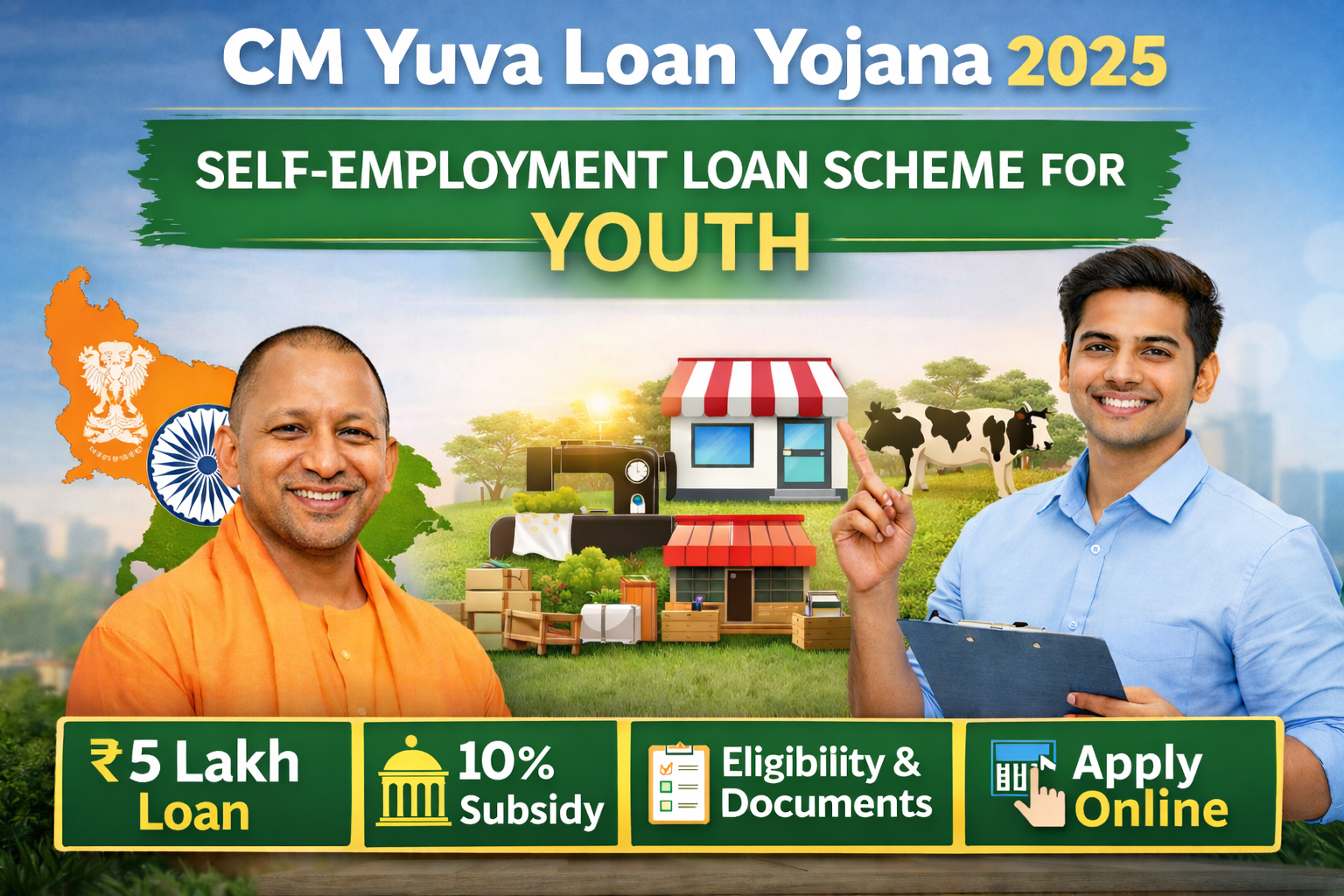

CM Yuva Loan Yojana 2025: Online Apply, Eligibility, Subsidy & Project Report

Focus Keyword: CM Yuva Loan Yojana

CM Yuva Loan Yojana Kya Hai?

CM Yuva Loan Yojana Uttar Pradesh Government ki ek important scheme hai jiska aim yeh hai ki yuva apna khud ka business start kar saken. Is yojana ke under eligible applicants ko bank loan + government subsidy di jati hai.

Ye scheme un logon ke liye best hai jo job nahi milne ki wajah se business shuru karna chahte hain.

CM Yuva Loan Yojana Ke Fayde

CM Yuva Loan Yojana ke main benefits:

- Self employment ka mauka

- Low interest par bank loan

- Government ki taraf se subsidy

- Small business start karne me madad

- SC / ST / OBC / Women ko extra benefit

CM Yuva Loan Amount Kitna Milta Hai?

CM Yuva Loan Yojana me do tarah ke loan milte hain:

- Term Loan (TL): ₹25,000 – ₹5,00,000

- Cash Credit (CC): ₹25,000 – ₹5,00,000

👉 Loan amount aapke project report aur bank eligibility par depend karta hai.

CM Yuva Loan Yojana Me Subsidy

Government is scheme me margin money subsidy deti hai:

- General Category: 15% subsidy

- SC / ST / OBC / Minority / Women / Divyang: 25% subsidy

⚠ Subsidy loan account me adjust hoti hai, cash me nahi milti.

CM Yuva Loan Yojana Eligibility

Apply karne se pehle eligibility check kare:

- Applicant Uttar Pradesh ka resident ho

- Age 18 se 40 saal

- Minimum 8th pass / ITI / Diploma / Graduation

- Applicant unemployed ho ya naya business shuru karna chahta ho

- Civil Score 650+ hona better hai

CM Yuva Loan Ke Liye Required Documents

CM Yuva Loan apply karte waqt ye documents chahiye:

- Aadhaar Card

- PAN Card

- Address Proof

- Education Certificate

- Passport Size Photo

- Bank Passbook

- Project Report

- Mobile Number & Email ID

CM Yuva Loan Yojana Online Apply Kaise Kare?

CM Yuva Loan Yojana ka apply process simple hai:

- CM Yuva Loan official portal par visit kare

- New registration kare

- Login karke application form bhare

- Project report upload kare

- Documents attach kare

- Final submit kare

Application submit hone ke baad bank verification hota hai.

CM Yuva Loan Me Kaunse Business Allowed Hain?

Is scheme me kai tarah ke business allowed hain jaise:

- Computer Training Center

- Beauty Parlour

- Mobile Shop

- Dairy Farming

- Tailoring Unit

- Repairing Center

- Small Manufacturing Unit

CM Yuva Loan Aur Civil Score Ka Role

CM Yuva Loan approval me Civil Score important role play karta hai:

- High Civil Score → Fast approval

- Low Civil Score → Delay ya rejection

Apply karne se pehle apna Civil Score zaroor check kare.

CM Yuva Loan Repayment Period

- Loan repayment period 3 se 7 saal

- EMI business income ke hisaab se

- Kuch cases me moratorium period bhi milta hai

CM Yuva Loan Yojana – Conclusion

CM Yuva Loan Yojana 2025 un yuvaon ke liye ek golden opportunity hai jo job se business ki taraf badhna chahte hain. Agar aapke paas strong project report aur achha civil score hai to loan approval ke chances kaafi badh jate hain.

FAQs – CM Yuva Loan Yojana

Q1. CM Yuva Loan Yojana me maximum loan kitna milta hai?

Maximum ₹5,00,000 tak ka loan mil sakta hai.

Q2. CM Yuva Loan me subsidy kaise milti hai?

Subsidy loan account me adjust hoti hai, direct cash nahi milta.

Q3. CM Yuva Loan ke liye civil score kitna hona chahiye?

650+ civil score hone par approval chances achhe hote hain.

Disclaimer

Yeh article sirf information purpose ke liye hai. Loan approval aur subsidy bank aur government rules par